How It Works

Segregated Accounts

Users invest in this product through segregated investment accounts, enhancing security and

regulatory compliance.

Know more

+

Portfolio Personalization

Risk Assessment: Users complete an interactive questionnaire to determine their

risk tolerance.

Know more

+

Continuous Monitoring and Adjustments

Automatic Rebalancing: The platform regularly makes adjustments to keep the portfolio aligned with the user's preferences.

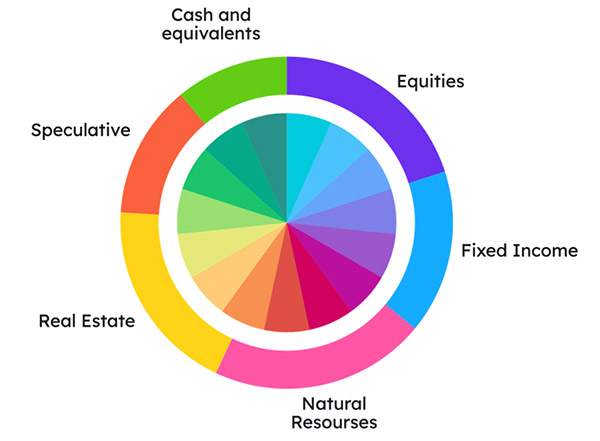

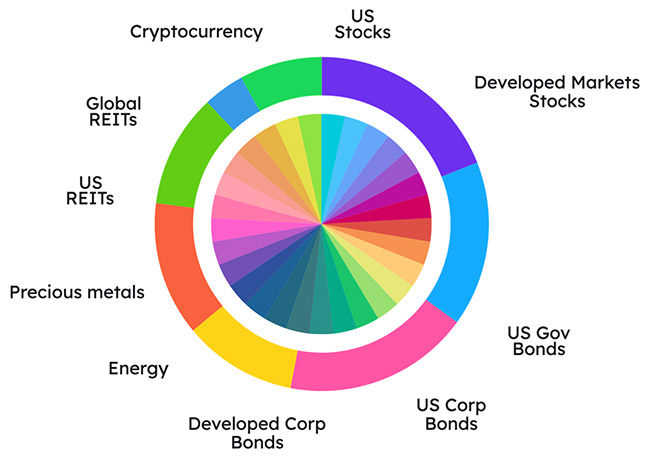

Instruments

Wealth2B recommends a globally diversified investment portfolio, optimized for the long term and adjusted to each user's risk tolerance. The goal is to achieve diversification across currencies, sectors, and geographies.